Do you understand the difference between a quantitative trader and a quantitative researcher? Although many do not, there is a significant difference between the two roles. While a quantitative researcher is in charge of creating and enhancing these models, a quantitative trader is in charge of placing trades based on mathematical models. We’ll look at how these two roles differ in this blog post and talk about which one would be best for you.

quantitative traders

To make trades, quantitative traders utilize mathematical models. They are in charge of conducting data analysis and choosing when to buy or sell securities.

You will be required to submit a few ideas each year, which you will likely present in white papers. In a way, you are conducting scientific research. After then, you don’t really care about anything, including the implementation and trading processes. PhDs are in demand for this position since they have already shown they can conduct research that requires a lot of maths.

Much more practical. You’ve been given a model, and the next step is to put it into practise. Many individuals appear to believe that computers can handle anything. But it’s not quite that easy. A few trades each month may be needed for some techniques, while millions may be needed for others. Along with trading, you can also be concerned about risk, leverage, borrowing, and spending time interacting with brokers, banks, etc. You have excellent market knowledge.

quantitative researchers

Quantitative researchers create and enhance these models. They experiment with different data modelling techniques to see how effectively they can forecast market behavior.

Quantitative researchers will be required to submit a few ideas each year, which you will likely present in white papers. In a way, you are conducting scientific research. After then, you don’t really care about anything, including the implementation and trading processes. PhDs are in demand for this position since they have already shown they can conduct research that requires a lot of maths.

Difference between Quantitative researchers and quantitative traders

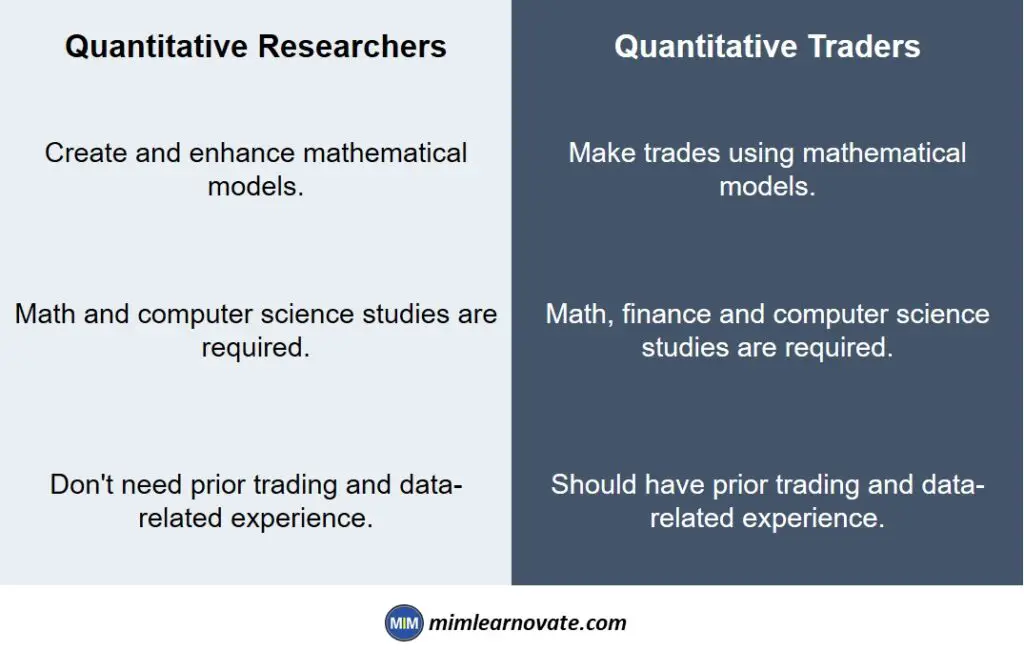

- The main goal of quantitative research is to create and enhance mathematical models. The main goal of quantitative trading is to make trades using those models.

- A different set of skills are needed for quantitative research than for quantitative trading.

- Strong math skills are essential for quantitative researchers. They must also have the ability to program computers to carry out complex tasks. Studying math and computer science is a need if you want to work in the field of quantitative research.

- Strong math abilities are also necessary for quantitative traders. They must also have the ability to programme computers to carry out complex tasks. However, they also need to have prior trading and data-related experience. Math, computer science, and finance are the three subjects you should focus on if you want to become a quantitative trader.

Quantitative Researchers vs. Quantitative Traders

| Quantitative researchers | Quantitative traders |

| Create and enhance mathematical models. | Make trades using mathematical models. |

| Math and computer science studies are required. | Math, finance and computer science studies are required. |

| Don’t need prior trading and data-related experience. | Should have prior trading and data-related experience. |

Which one to Choose? Quantitative Researchers or Quantitative Traders

A job as a quantitative trader may be a good fit for you if you’re interested in a career in finance but don’t have much math or computer knowledge. A job as a quantitative researcher can be a better fit if you’re more interested in the research side of things and have great math and programming skills.

Do you want to work with data? Do you want to develop models? Or do you wish to make trades using those models? You can decide if a career as a quantitative trader or researcher is suited for you by answering the following questions.

Strong math abilities are required for both quantitative traders and researchers. They must also have the ability to programme computers to carry out difficult jobs. If you possess these abilities, either position can be a suitable fit for you. What you’re interested in and want to do with your job are truly the determining factors.

Why not test both roles if you’re unsure whether one is best for you? In addition to their day jobs as quantitative traders, many people also work in research. Additionally, a lot of quantitative researchers have prior trading expertise. So don’t worry if you can’t chose between the two. You can always give both a try and decide which you prefer.