Systemic and systematic risks have very different meanings in the world of finance despite the words’ similarity. Below, we’ll look more closely at their definitions and differences so that you may develop a risk management strategy that works better and protect your portfolio.

systemic risk

A systemic risk is a word used in medicine to indicate a specific health problem that later affects the entire body. It has a similar meaning in finance. A systemic risk is the possibility that one event could lead to the collapse of a whole industry or the entire economy. The corporate-level event frequently leads to a general market downturn. Systemic risks can be reduced by diversifying your portfolio.

Read More:

How does Ethereum work? Ethereum vs Bitcoin

Qualitative Trading vs Quantitative Trading

Quantitative Researchers vs. Quantitative Traders

Example: systemic risk

Individual businesses, financial institutions, or entire industries failure are examples of systemic risks.

Smaller events, such as security flaws found on a bank account, might also be considered systemic risks. The business or sector can be seriously impacted by even the smallest systemic risks, and the failure of important banking institutions could trigger an economic crisis and market collapse.

Systematic risk

While individual events having the potential for broad consequences are referred to as systemic risks, the concept of a systematic risk is fundamentally different. A systematic risk is one that is already present in the economy. Systematic risk, which is also known as “market risk,” affects the entire market as opposed to just one particular sector or industry.

Systematic risk occurs when the economy as a whole is weak. This weakness could be due to monetary policy, fiscal policy, international trading rules, conflict, or an economic downturn. These are all important factors.

Example: Systematic risk

Systematic risks include those posed by political situations, economic conditions, currency volatility, and interest rates. These dangers are unavoidable for investors. Systems of risk management must merely take political and political instability into consideration.

Difference between Systemic Risk and Systematic Risk

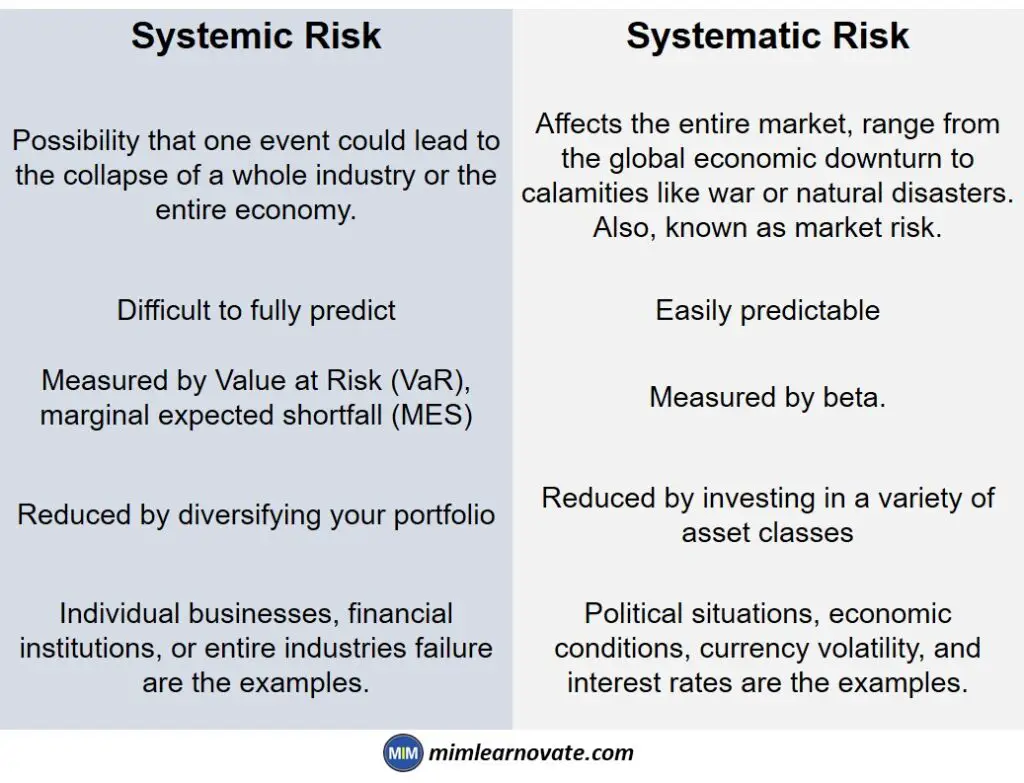

When comparing systemic versus systematic risk, it’s important to be aware of the following key differences:

- Definition: Systemic risks are situations that can be caused by a single event and may ultimately result in a larger collapse or downturn. The causes of systematic risk, which affects the entire market, range from the global economic downturn to calamities like war or natural disasters.

- Measurement systems: Investors may employ methods like marginal expected shortfall (MES), which considers how a company’s specific risk affects overall industry risk, to quantify systemic risk. Beta is used by investors to assess systematic risk in relation to a portfolio. If your portfolio has a value greater than or equal to one, it involves more systematic risk because it is affected by market volatility.

- Predictability: Since it’s frequently unclear how the failure of a financial institution or company may have larger economic consequences, systemic risks are difficult to fully predict. However, if discovered, systematic risks can follow a reasonably predictable pattern. We can plan accordingly, for instance, because we are aware of how recessions and an increase in interest rates often affect the market.

- Risk management: By diversifying your portfolio, you can avoid systemic risks. This makes sure that you don’t invest all of your money in a single business, industry, or area. You would lose your investment if that company or industry failed. However, due to its broad nature, systematic risk cannot be reduced through diversification. However, you can reduce systematic risks by investing in a variety of asset classes, such as a mix of equities, cash, and real estate. For instance, commodities like gold are a well-liked choice for investors wishing to stay away from systematic risk.

Systemic Risk vs. Systematic Risk

| Systemic Risk | Systematic Risk |

| Possibility that one event could lead to the collapse of a whole industry or the entire economy. | Affects the entire market, range from the global economic downturn to calamities like war or natural disasters. Also, known as market risk. |

| Difficult to fully predict | Easily predictable |

| Measured by Value at Risk (VaR), marginal expected shortfall (MES) | Measured by beta. |

| Reduced by diversifying your portfolio | Reduced by investing in a variety of asset classes |

| Individual businesses, financial institutions, or entire industries failure are the examples. | Political situations, economic conditions, currency volatility, and interest rates are the examples. |

Example: Systemic Risk vs. Systematic Risk

The 2008 collapse of Lehman Brothers would be an important example of systemic risk. A wider banking collapse resulted from the bankruptcy of this international provider of financial services.

We can consider the Covid-19 epidemic as an example of systematic risk. Pandemic risk is always present, but it is difficult to predict. This resulted in widespread company closures, lockdowns, and delays to international travel when it happened.

Another example of systematic risk is the way various asset classes were affected by the financial crisis and Great Recession of 2008 in various ways.

Conclusion

To create a well-thought-out risk management system, it is necessary to keep in mind the differences between systemic and systematic risk. The most effective strategy to reduce risk of any kind is through diversification, both in terms of individual stocks and asset classes.

Other articles

Please read through some of our other articles with examples and explanations if you’d like to learn more.

Management

- Human Resource Management

- Management Information System

- Why is Information Governance Important?

- How Data Analysis Is Changing Information Governance?

- The St. Gallen Management Model

- System-Oriented Management

- Tools Transforming Knowledge Management

- Levels of Management

- Information Management Software

- Tools for Information Management

- Information Governance vs Records Management

- Management Information System Books

- Greenwashing: A Case Study on DWS

- Greenwashing Examples

Statistics

Marketing

- Strategic marketing planning

- Marketing Environment

- Consumer buying decision process

- Factors Influencing Consumer Behavior

- Product Positioning

- Target Market Strategies

- Market Segmentation

- STP Process

- Data Analysis Process

- Consumer Adoption Process

- Branding

- Product Life Cycle

- Product Attributes

- Price Discrimination

- Service-Based

- Company Vs. Product-Based Company

- Product Classification

- Penetration Pricing and Price Skimming

- Differentiated vs Undifferentiated Marketing

- Case Study of Nestle

- Fast-Moving Consumer Goods

- Motorola’s Customer-Defined, ‘Six-Sigma Quality

- PEST And a SWOT Analysis

- Web Design Company Vs. a Web Designer

- Internal and External SWOT Analysis

- Strategic Opportunism

Marketing Analysis

Finance

- How AI Chatbots Can Identify Trading Patterns?

- Billion to Crore

- AMORTIZED COST

- Amortized Cost vs Fair Value

- Qualitative Trading vs Quantitative Trading

- Systemic Risk vs. Systematic Risk

- Quantitative Researchers vs. Quantitative Traders

- Blockchain Revolutionize the Banking Sector

- Blockchain transform the Finance

- gold on blockchain

- Use cases of Soulbound Tokens

- Bitcoin halving

- Ethereum vs Bitcoin –

- Vitalik Buterin N

- artificial intelligence stocks under $10

- Federal Funds Rate

- Top-performing stocks |

- Investing in Stocks

ChatGPT

- ChatGPT For Keyword Research

- Prompts for New Business Idea Generation

- ChatGPT Business Entrepreneur

- Learn Languages with ChatGPT

- Use ChatGPT on WhatsApp

- ChatGPT as Virtual Research Assistant

- ChatGPT for Meta-Analysis in Research

- ChatGPT For Large Documents

- ChatGPT for Hypothesis Development

- ChatGPT for Text Analysis

- ChatGPT to Write Code in Python

- ChatGPT to Write Literature Review

- Books ChatGPT