Companies can value bonds in a number of different ways. The most popular technique among these is valuation using the amortized cost method. However, some businesses might also assess their bonds based on fair value.

Amortized Cost and Fair Value are different from one another in a few ways. To differentiate between these two methods, it is preferable to understand each one separately.

Amortized cost

A bond’s initial cost after deductions is represented by its amortized cost. Adjustments for principal repayments, amortization, and impairment, if any, are included in these deductions. The amortized cost technique is also used by businesses that value their assets and liabilities using the cost accounting method.

Read More: WHAT IS AMORTIZED COST?

The amortized cost may apply to fixed assets in addition to financial instruments and securities. The accumulated fraction of a fixed asset’s recorded cost is represented by its amortized cost.

These could involve costs like amortization and depreciation. Both of these expenses are ones that businesses directly deduct from income in order to lower the cost of fixed assets.

The word “amortized cost” can also refer to the accumulated quantity of natural resource depletion. In general, an amortized cost is one that a company charges as an expense and which lowers the value of a fixed asset.

It’s possible that an asset’s market worth and its amortized cost are unrelated. Market forces, which do not correspond to amortized expenses, determine market value. The amortized cost, in contrast, is influenced by things like depreciation and amortization. As a result, the amortized cost increases along with the rates for these.

What is the Amortization Cost of a Bond?

A bond’s amortization is the process of paying back the purchase price at regular intervals until the bond matures.

Paying the principal and interest on a bond over a fixed length of time is referred to as amortization. The bond’s face value plus its unamortized value are combined to form the bond’s carrying value.

An amortized bond’s price fluctuates as it pays additional interest over the course of its amortisation schedule. The bond’s credit default risk decreases over time.

Additionally, it lessens the bond’s interest rate risk. These two factors play an essential role in determining the value of an amortized bond.

The amortization of the bond can be computed using either the straight-line method or the effective interest rate method.

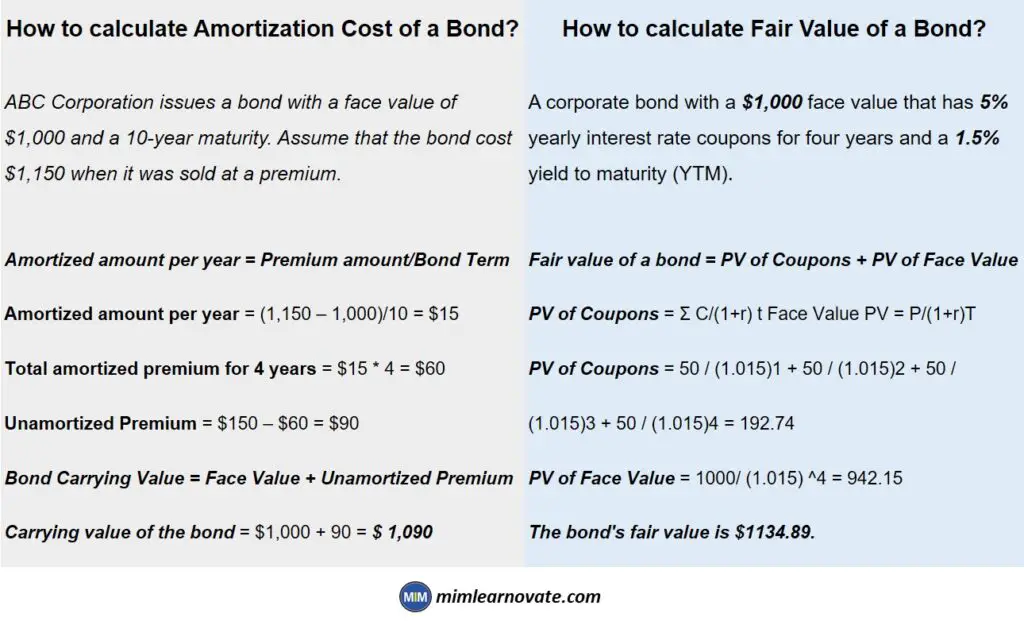

Example: How to calculate Amortization Cost of a Bond?

ABC Corporation issues a bond with a face value of $1,000 and a 10-year maturity. Assume that the bond cost $1,150 when it was sold at a premium.

Let’s calculate the bond’s value after four years of amortization.

Amortized amount per year = Premium amount/Bond Term

Amortized amount per year = (1,150 – 1,000)/10 = $15

Total amortized premium for 4 years = $15 * 4 = $60

Unamortized Premium = $150 – $60 = $90

Bond Carrying Value = Face Value + Unamortized Premium

Carrying value of the bond = $1,000 + 90 = $ 1,090

Fair Value

The intrinsic value of an asset or liability is determined using the valuation method known as fair value. The mark-to-market approach is used by businesses to calculate the fair value of accounts that change over time. Both assets and liabilities may be included in these.

By using this technique, businesses can get a realistic appraisal of their current financial position depending on the current condition of the market.

The amount that is paid in a transaction between two parties is represented by the fair value of an asset or liability. Similarly, the transaction should be completed in an orderly fashion in an open market, indicating that both parties are willing.

The value must also be agreed upon by both parties in order for it to be regarded as fair value. The fair value of an asset or liability might change over time because it is based on market conditions.

The fair value of securities and stocks is the price that consumers would be prepared to pay for them in a market where they are publicly traded. It can be close to the asking price for the seller. In contrast, it is near to the bid price for the buyer. Companies can calculate the fair value of their assets and liabilities using both of these prices.

Unlike amortized cost, the fair value of an asset or liability does not take into account depreciation and amortization. After a reasonable period of time, businesses may also recalculate the fair value of their assets or liabilities. They don’t base their decisions on the previous price or value of their goods.

What is the Fair Value of a Bond?

A bond’s fair value is determined by adding its book value at maturity to the present value of all of its future interest payments.

A bond’s face value or book value is fixed. As market interest rates fluctuate, so can the interest payments on a bond. The majority of bonds are issued with a fixed interest rate.

However, when the market interest rate changes, investors anticipate an adjusted bond yield. Either the bond’s interest rate or market price (premium or discount) can be changed to accomplish this.

A bond’s face value, or par value, is used to describe changes in a bond’s fair value. Trading above par refers to when a security is trading above its par value, and trading below par refers to when a security is trading below its par value.

Example: Amortized Cost vs Fair Value

Example: How to calculate Fair Value of a Bond?

A corporate bond with a $1,000 face value that has 5% yearly interest rate coupons for four years and a 1.5% yield to maturity (YTM).

By applying the following formula, we may determine the bond’s fair value:

Fair value of a bond = PV of Coupons + PV of Face Value

PV of Coupons = Σ C/(1+r) t Face Value PV = P/(1+r)T

PV of Coupons = 50 / (1.015)1 + 50 / (1.015)2 + 50 / (1.015)3 + 50 / (1.015)4 = 192.74

PV of Face Value = 1000/ (1.015) ^4 = 942.15

The bond’s fair value is $1134.89.

Amortized Cost vs Fair Value

The amortized cost merely gives the bond’s carrying value. It is a method of calculating how much of an interest payment on a bond has been amortized at a specific time.

It excludes the impact of the market on a bond’s price. In other words, it determined the bond’s theoretical carrying price at a particular time.

The carrying value of the bond near its par value as it near maturity.

The demand-supply relationship of the bond is one of many other criteria that go into determining the bond’s fair value. It involves comparing the interest rate on the bond with the interest rate on the market.

The fair value of an amortized bond may differ from its carrying value because investors may be ready to take risks in anticipation of better future returns.

Additionally, the carrying value of an amortized bond is unaffected by the creditworthiness of the bond issuer. However, it directly impacts a bond’s fair market value.

CONCLUSION

Companies employ two different types of valuation: amortized cost and fair value. The value of an asset or liability after changes to its initial cost is referred to as amortized cost. These adjustments include of things like impairment, amortization, and depreciation. Fair value is the open market value of an asset or a liability that is decided upon by market participants in a smooth transaction

Other articles

Please read through some of our other articles with examples and explanations if you’d like to learn more .

Management

- Human Resource Management

- Management Information System

- Why is Information Governance Important?

- How Data Analysis Is Changing Information Governance?

- The St. Gallen Management Model

- System-Oriented Management

- Tools Transforming Knowledge Management

- Levels of Management

- Information Management Software

- Tools for Information Management

- Information Governance vs Records Management

- Management Information System Books

- Greenwashing: A Case Study on DWS

- Greenwashing Examples

- Bureaucracy Theory of Management

Statistics

Marketing

- Strategic marketing planning

- Marketing Environment

- Consumer buying decision process

- Factors Influencing Consumer Behavior

- Product Positioning

- Target Market Strategies

- Market Segmentation

- STP Process

- Data Analysis Process

- Consumer Adoption Process

- Branding

- Product Life Cycle

- Product Attributes

- Price Discrimination

- Service-Based

- Company Vs. Product-Based Company

- Product Classification

- Penetration Pricing and Price Skimming

- Differentiated vs Undifferentiated Marketing

- Case Study of Nestle

- Fast-Moving Consumer Goods

- Motorola’s Customer-Defined, ‘Six-Sigma Quality

- PEST And a SWOT Analysis

- Web Design Company Vs. a Web Designer

- Internal and External SWOT Analysis

- Strategic Opportunism

Marketing Analysis

Finance

- How AI Chatbots Can Identify Trading Patterns?

- Billion to Crore

- AMORTIZED COST

- Amortized Cost vs Fair Value

- Qualitative Trading vs Quantitative Trading

- Systemic Risk vs. Systematic Risk

- Quantitative Researchers vs. Quantitative Traders

- Blockchain Revolutionize the Banking Sector

- Blockchain transform the Finance

- gold on blockchain

- Use cases of Soulbound Tokens

- Bitcoin halving

- Ethereum vs Bitcoin –

- Vitalik Buterin N

- artificial intelligence stocks under $10

- Federal Funds Rate

- Top-performing stocks |

- Investing in Stocks

ChatGPT

- ChatGPT For Keyword Research

- Prompts for New Business Idea Generation

- ChatGPT Business Entrepreneur

- Learn Languages with ChatGPT

- Use ChatGPT on WhatsApp

- ChatGPT as Virtual Research Assistant

- ChatGPT for Meta-Analysis in Research

- ChatGPT For Large Documents

- ChatGPT for Hypothesis Development

- ChatGPT for Text Analysis

- ChatGPT to Write Code in Python

- ChatGPT to Write Literature Review

- Books ChatGPT