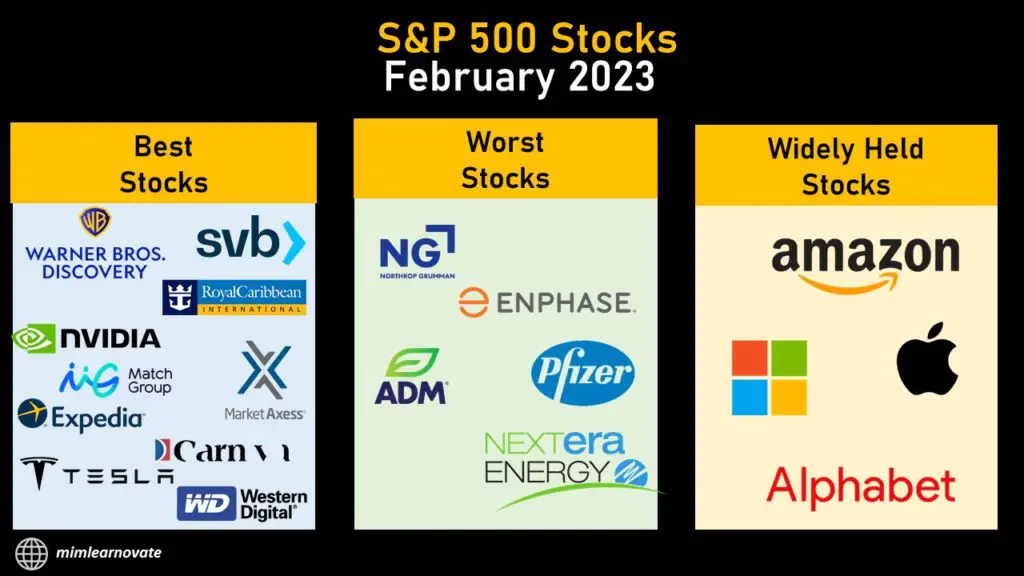

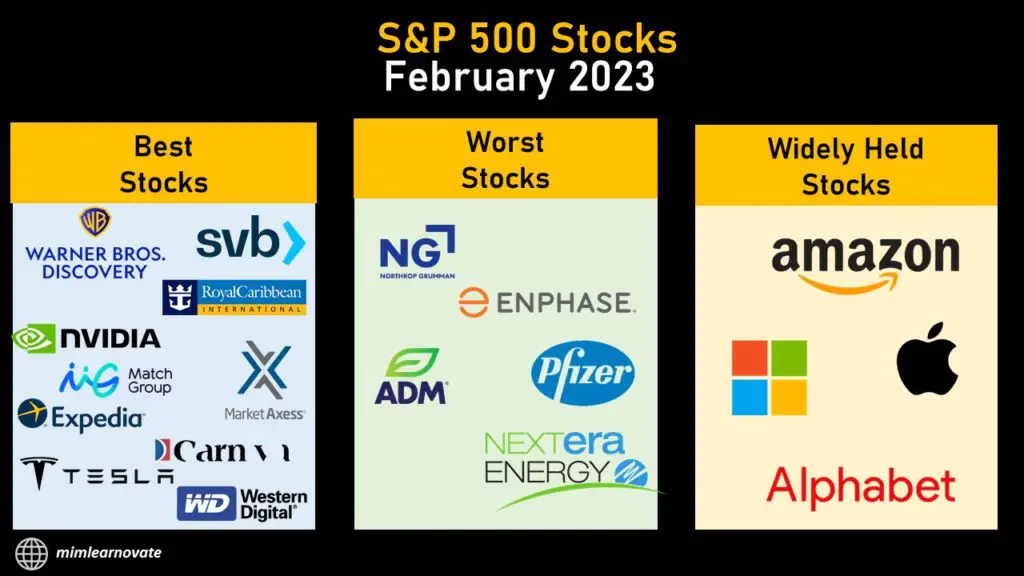

I’m going to share with you today the top ten stocks to buy in February 2023 that I think will have a lot of potential growth for long-term investors. Also, you will get to know about worst stocks and widely held stocks in February 2023

One of the most popular stock indexes in the world, the Standard & Poor’s 500 Index includes a large number of the best-known American corporations. The index has a solid track record of returns, with long-term returns averaging roughly 10% yearly. As a leading indicator of the market and economy overall, investors regularly monitor the index and its top stocks.

Even if many top stocks continue to provide strong returns year after year, a list of the best-performing stocks won’t tell you which will do well in the future. Following the greatest stocks may provide you a hint as to which competitors may perform well in the years to come. For example, Amazon and Apple seem to have given favourable increases for what seems like forever.

The S&P 500’s top-performing stocks for 2023 are listed below.

Best S&P 500 stocks February 2023

| 2023 Performance | Company |

| 30.4% | Match Group (MTCH) |

| 30.5% | MarketAxess Holdings (MKTX) |

| 30.5% | Expedia (EXPE) |

| 31.4% | Royal Caribbean Cruises (RCL) |

| 31.4% | SVB Financial (SIVB) |

| 33.7% | NVIDIA (NVDA) |

| 34.2% | Carnival Corporation (CCL) |

| 39.3% | Western Digital (WDC) |

| 40.6% | Tesla (TSLA) |

| 56.3% | Warner Bros. Discovery (WBD) |

Naturally, even the best-performing stocks occasionally underperform, so it can be beneficial to keep a watch on a few of these. This is because underperformers this year could outperform this year next year, and if you locate a once-star stock among the losers, it might be ready for a steal of a deal.

The worst-performing S&P 500 stocks for 2023 are shown below.

Worst S&P 500 stocks February 2023

| 2023 Performance | Company |

| -10.7% | NextEra Energy (NEE) |

| -10.8% | Archer-Daniels-Midland (ADM) |

| -13.8% | Pfizer (PFE) |

| -16.5% | Enphase Energy (ENPH) |

| -17.9% | Northrop Grumman (NOC) |

Widely held stocks 2023

Here are the results of some of the S&P 500’s most widely held stocks.

| 2023 Performance | Company |

| 40.6% | Tesla (TSLA) |

| 22.8% | Amazon (AMZN) |

| 12.0% | Alphabet (GOOGL) |

| 3.3% | Microsoft (MSFT) |

| 11.1% | Apple (AAPL) |

How to Invest in February 2023?

At least historically speaking, the robust stock market performance in January portends favourably for the rest of 2023.

The S&P 500 index has ended the year higher 86% of the time since 1950 when the month of January is positive. On the other hand, the S&P 500 has only closed the year in positive territory 2.1% of the time when it trades lower in January.

As the second-largest economy in the world relaxes its Zero-COVID regulations, including removing lockdowns and reducing travel restrictions, Chinese stocks are off to a strong start in 2022 and may continue to rise.

US Recession

However, investors who are still worried about the likelihood of a U.S. recession in 2023 may want to adopt a more defensive strategy and reduce their stock exposure.

With institutions covered by the Federal Deposit Insurance Corporation (FDIC), investors can earn 4% interest on high-yield savings accounts, and those yields will probably increase if the FOMC raises interest rates in the upcoming months.

In the past, value stocks have performed better than growth stocks when interest rates are high. Discounted cash flow valuations are impacted negatively by high interest rates, which has a disproportionately unfavourable effect on high-growth firms.

The Vanguard Growth ETF (VUG) has decreased by 15.5% over the past year, whereas the Vanguard Value ETF (VTV) has decreased by less than 0.1%.

Additionally, some market segments have earnings that are comparatively predictable, stable, and partially protected from cyclical economic downturns.

As defensive market categories, utilities, consumer staples, and healthcare stocks can help investors reduce risk across their whole portfolios until macroeconomic conditions improve.

Tech Layoffs

According to Carol Schleif, chief investment director of BMO Family Office, buyers should also hunt for bargains in the beaten-down technology industry.

“The layoffs we have witnessed in the tech industry in recent weeks represent a small percentage of the recruiting that has taken place at many of these businesses over the last few years, but the values of many large tech companies seem to imply armageddon,” adds Schleif.

In the fourth quarter, tech stocks are anticipated to post a 0.6% year-over-year reduction in sales and a 14.1% decline in EPS.

Investing in the hottest stocks

It’s challenging to invest in individual stocks. You must conduct background study on the company and the sector, as well as comprehend the dynamics that underpin everything. That’s OK for those who have the necessary time, skills, and motivation to succeed in this situation.

But what if you don’t willing to put in that kind of effort but yet want to take advantage of stocks’ attractive return?

Any investor can take part, even those with minimal experience. An investor of any level can easily buy a fund based on the S&P 500 index. Since the fund holds shares in every company in the index, you actually own a little portion of hundreds of stocks.

This configuration also ensures that, even if you aren’t investigating and evaluating the different stocks within it, your performance will typically follow the performance of the index over time, roughly 10% yearly over lengthy periods.

By purchasing this type of index fund, you’ll receive the weighted average of all the holdings and, over time, beat the majority of investors, including professionals.

Mutual funds and exchange-traded funds (ETFs) are the two main types of index funds. Each has some advantages and disadvantages. In any case, you gain access to the opportunity to watch an index at a generally cheap cost—often just a few dollars per year for every $10,000 invested.

The index fund must be held through the ups and downs, allowing the investment the time to withstand volatility, if you want to achieve the index’s returns. Otherwise, as the index fluctuates, you’ll probably find yourself selling low and purchasing high.

[sp_easyaccordion id=”3782″]