A Transaction Processing System (TPS) is a type of information processing system utilized for managing business transactions, encompassing tasks such as data retrieval, collection, and modification. It provides an environment for executing these transactions while guaranteeing data availability, security, and integrity.

Additionally, TPS ensures rapid response times and maintains high levels of accuracy in processing transactions.

Transaction Processing System (TPS)

A Transaction Processing System (TPS) is an information processing system designed to handle all transactions occurring within a business, including the modification, collection, and retrieval of transaction data. It is known for its consistency, efficiency, and reliability, making it a crucial component for online businesses engaged in e-commerce.

Components of Transaction Processing System (TPS)

A well operating Transaction Processing System (TPS) depends on four primary components that cooperate to efficiently manage business transactions

- Inputs:

- Processing:

- Outputs:

- Database:

1. Inputs:

Inputs serve as the initial stage of a transaction within a TPS. They encompass the data or directives entering the system, usually triggered by a user or an external system. Inputs can take various forms such as customer orders, payment details, and updates to inventory.

These are the original requests for payments or products sent to the organization’s TPS by external parties.

Examples of inputs include bills, coupons, custom orders, and invoices.

2. Processing System:

When the TPS receives the input, the processing unit becomes active. It interprets the data, checks its accuracy, and executes the required actions according to the transaction type.

Typical processing tasks include calculating order totals and discounts, verifying customer information and credit card details, updating inventory levels, and generating invoices and receipts.This component of the TPS is responsible for processing each input and producing a meaningful output, such as a receipt.

It interprets input data and determines the appropriate outputs. The processing time can vary depending on the type of TPS utilized by an organization.

3. Outputs:

After processing all inputs, a TPS generates documents such as receipts, which are stored by companies for record-keeping purposes. These documents serve to validate transactions and provide important reference details for tax and other official purposes.

Following the input processing, the TPS produces an output as the transaction outcome. Outputs can be delivered through different means, like displaying a confirmation message on a screen (e.g., order confirmation), printing receipts or invoices, updating customer accounts or databases, and sending email notifications (e.g., order shipped).

4. Storage / Database:

The storage component of a TPS is where organizations store both input and output data. This may involve using databases to ensure the security, accessibility, and organization of documents for future use.

It encompasses data related to customers (names, addresses, purchase history), products (descriptions, prices, stock levels), employees (payroll details, work schedules), and financial transactions (sales records, payments received).

This system guarantees that these components function seamlessly, leading to smooth transaction processing, precise data management, and streamlined business operations.

Key features of Transaction Processing Systems (TPS)

Some key features of Transaction Processing Systems (TPS) include:

- Controlled Access: Only authorized personnel can access and operate a TPS, ensuring security and proper handling of transactions.

- Integration with External Environment: TPSs interact with external entities like suppliers and customers, facilitating information exchange and transaction processing.

- Rapid Response Time: TPSs prioritize quick transaction processing to meet customer expectations and business efficiency standards.

- Standardized Processing: TPSs follow predefined procedures for handling transactions uniformly, regardless of factors like time, user, or customer, to optimize operational consistency.

- Reliability and Security: TPSs must maintain high reliability levels to prevent errors and ensure data security, fostering customer trust and satisfaction.

- Information Distribution: TPSs generate and share transaction-related data with other systems, enhancing coordination and streamlining business processes, such as sales processing systems communicating with general ledger systems.

Types of Transaction Processing Systems (TPS)

Transaction Processing Systems (TPS) are categorized into two main types:

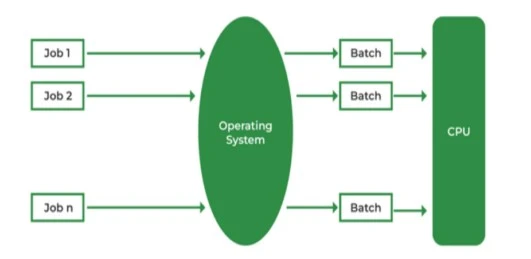

Batch Processing

Batch Processing is a method where TPS interprets data in batches or groups, categorizing items based on similarities. This approach involves reviewing and processing multiple data sets simultaneously, which can lead to delays in transaction processing.

However, these delays are generally acceptable because batch processing is not meant to be done continuously. Businesses can customize batch processing according to their needs, such as processing employee wages once every two weeks. This type of processing is efficient for handling large volumes of similar transactions at scheduled intervals.

Batch processing involves grouping and processing transactions periodically, in batches. This method is suitable for tasks that are not time-sensitive and can be accumulated over time.

Examples of batch processing

Examples of batch processing tasks include:

- Payroll processing

- Generating reports

- Sending out invoices

Real-Time Processing

Real-Time Processing is designed to process transactions instantly, without any delay. This means that transactions take effect immediately upon processing, making it ideal for businesses dealing with individual or singular transactions.

Real-time processing ensures quick responses to customer requests and transactions, enhancing customer satisfaction and operational efficiency. It is particularly beneficial for businesses that require immediate transaction processing and quick decision-making based on real-time data.

A Transaction Processing System (TPS) processes transactions as they occur, providing immediate updates and responses. This real-time processing system is commonly experienced when making online purchases and receiving instant order confirmations.

Examples of Real-Time Processing

Real-time processing systems are particularly suited for scenarios where up-to-the-minute data is crucial. Examples include:

- Online banking transactions

- Stock exchanges

- Airline reservation systems

Batch Processing and Real-time Processing

The choice between batch processing and real-time processing depends on the nature of the business, the volume and frequency of transactions, and the desired speed of transaction processing.

Batch processing is suitable for handling large volumes of transactions in scheduled batches, while real-time processing is preferable for immediate transaction processing and quick response times.

Both types of TPS play crucial roles in managing business transactions effectively, catering to different operational needs and requirements.

Examples of Transaction Processing Systems (TPS):

Here are a couple of examples that illustrate the functioning of Transaction Processing Systems (TPS):

Example:

Ali decides to buy a t-shirt from Amazon, an online clothing store.

He makes the purchase using his credit card. Amacon’s Transaction Processing System (TPS) kicks in to handle the transaction.

The TPS collects David’s credit card details securely, communicates with the bank for authorization, and checks David’s account balance. Upon receiving approval from the bank, Amazon’s TPS completes the transaction, deducts the purchase amount from David’s account, and generates a receipt for the transaction.

Example:

John is a subscriber to Chill TV, a streaming platform for TV shows and movies. He pays for his Chill TV subscription at the start of each month. Chill TV’s TPS processes all subscription payments as a batch, handling multiple transactions simultaneously.

Since these transactions occur in sets and are processed once a month, Chill TV’s TPS is designed to handle high computing loads during these processing periods.

While there may be a slight delay in processing transactions due to batch processing, it is acceptable in this scenario because the system is optimized for handling monthly subscription payments efficiently.

Real-world Examples of Transaction Processing Systems (TPS)

Here are some real-world examples of Transaction Processing Systems (TPS) across different industries:

1. Transaction Processing Systems (TPS) in Retail:

Point-of-Sale (POS) systems: When you make a purchase at a retail store like Walmart, the POS system captures your purchase information, updates inventory levels, and processes the transaction using your bank card or other payment methods.

2. Transaction Processing Systems (TPS) in Banking:

ATMs (Automated Teller Machines): Using an ATM to withdraw cash or check your account balance involves a TPS. The system verifies your identity, retrieves your account information, updates your balance, and dispenses cash or provides transaction receipts.

3. Transaction Processing Systems (TPS) in E-commerce:

Online shopping platforms: Shopping on e-commerce websites like Amazon or eBay relies on a TPS. The system processes your order details, verifies payment information, updates inventory levels, and generates order confirmations for customers.

4.Transaction Processing Systems (TPS) in Finance:

Stock exchanges: Trading on stock exchanges such as the New York Stock Exchange (NYSE) involves a complex TPS. It facilitates order matching between buyers and sellers, updates stock prices based on trades, and settles transactions electronically.

5. Transaction Processing Systems (TPS) in Airline reservations:

Airline reservation systems: Booking flights and managing reservations through airline websites or travel agencies use a TPS. The system checks seat availability, processes payment transactions, generates tickets, and sends confirmation emails to passengers.

Functions of Transaction Processing Systems (TPS)

Transaction Processing Systems (TPS) perform crucial functions that are essential for keeping a company’s operations running smoothly:

1. Recording Transactions

TPS carefully record all financial transactions within a company, including sales, purchases, payments, and other monetary activities. This recording is vital for maintaining a transparent and accurate record of the company’s financial activities.

2. Updating Data

Transaction Processing Systems update the company’s database with the latest transaction information. This updating process ensures that the data within the system remains current and reflects real-time transactional activities.

3. Maintaining Data Integrity

TPS adhere to strict data integrity rules to prevent errors, inconsistencies, and fraudulent activities from entering the system. By maintaining data integrity, TPS ensure the accuracy, reliability, and consistency of the information stored within the database.

4. Generating Reports

TPS systems are capable of generating reports summarizing various transactional activities. These reports provide valuable insights into the company’s financial performance, sales trends, customer behavior, inventory management, and other key metrics. The generated reports can be used by management to track progress, identify improvement areas, make informed decisions, and plan strategies for business growth.

Advantages and Disadvantages of Transaction Processing Systems (TPS)

Transaction Processing Systems (TPS) offer several advantages and disadvantages, impacting how organizations manage their transactions and operations.

Advantages of TPS:

- Cost Savings: TPS helps organizations save funds by reducing the need for system improvements or the use of multiple systems to meet demand. This efficiency translates into cost savings for businesses.

- Accurate and Quick Transactions: TPS enables companies to process transactions accurately and swiftly, ensuring smooth operations and customer satisfaction.

- Automation: TPS automates a significant portion of a company’s revenue management and internal processes. This automation allows employees to review transactions more efficiently, freeing up time for critical thinking tasks and strategic decision-making.

- Remote Operations: TPS facilitates remote work by allowing businesses to operate in multiple segments. This capability opens up new market opportunities and expands the reach of organizations.

Disadvantages of TPS:

- Lack of Standardization: TPSs may lack standard formats, leading to compatibility issues and complexity in data management.

- High Initial Setup Cost: Implementing a TPS often requires a significant initial investment in hardware, software, and infrastructure, which can be a barrier for some businesses.

- Compatibility Issues: Hardware and software compatibility problems can arise within a TPS, causing disruptions and requiring additional resources for troubleshooting and maintenance.

- Performance Issues: TPS may experience slowdowns or system failures when processing a large number of transactions simultaneously, impacting operational efficiency and customer experience.

FAQs

1. What are the three cycles of transaction processing systems?

A Transaction Processing System (TPS) consists of three cycles:

- Revenue cycle

- Conversion cycle

- Expenditure cycle

2. Is a transaction processing system a software?

A Transaction Processing System (TPS) comprises both hardware and software components to manage business transactions effectively.

3. How do BI systems differ from transaction processing systems?

Business Intelligence (BI) systems encompass processes, technologies, and applications aimed at improving company operations using data. In contrast, a TPS is an information processing system dedicated to processing all transactions within an organization.

4. What are the functions of a transaction processing system?

A TPS processes an organization’s transactions, records non-inquiry transactions in the database, and produces related transaction documents.

Other articles

Please read through some of our other articles with examples and explanations if you’d like to learn more.

Management

- Human Resource Management

- Management Information System

- Why is Information Governance Important?

- Transaction Processing System

- Decision Support Systems

- How Data Analysis Is Changing Information Governance?

- The St. Gallen Management Model

- System-Oriented Management

- Tools Transforming Knowledge Management

- Levels of Management

- Information Management Software

- Tools for Information Management

- Information Governance vs Records Management

- Management Information System Books

- Greenwashing: A Case Study on DWS

- Greenwashing Examples

Statistics

- PLS-SEM model

- Principal Components Analysis

- Multivariate Analysis

- Friedman Test

- Chi-Square Test (Χ²)

- T-test

- SPSS

- Effect Size

- Critical Values in Statistics

- Statistical Analysis

- Calculate the Sample Size for Randomized Controlled Trials

- Covariate in Statistics

- Avoid Common Mistakes in Statistics

- Standard Deviation

- Derivatives & Formulas

- Build a PLS-SEM model using AMOS

- Principal Components Analysis using SPSS

- Statistical Tools

- Type I vs Type II error

- Descriptive and Inferential Statistics

- Microsoft Excel and SPSS

- One-tailed and Two-tailed Test

- Parametric and Non-Parametric Test

Marketing

- Strategic marketing planning

- Marketing Environment

- Consumer buying decision process

- Factors Influencing Consumer Behavior

- Product Positioning

- Target Market Strategies

- Market Segmentation

- STP Process

- Data Analysis Process

- Consumer Adoption Process

- Branding

- Product Life Cycle

- Product Attributes

- Price Discrimination

- Service-Based

- Company Vs. Product-Based Company

- Product Classification

- Penetration Pricing and Price Skimming

- Case Study of Nestle

- Fast-Moving Consumer Goods

- Motorola’s Customer-Defined, ‘Six-Sigma Quality

- PEST And a SWOT Analysis

- Web Design Company Vs. a Web Designer

- Internal and External SWOT Analysis

- Strategic Opportunism

Marketing Analysis

ChatGPT

- Paraphrase Text

- PowerPoint Slides

- Learn Languages

- Write Code in Python

- Write Literature Review

- Document Review

- Job Interview Preparation

- Prompts For Students

- Write Cover Letter

- Write Resume

- Write Code

- Job Applications

- Write SQL Queries

- Write Excel Formulas

- Academic Writing

- Translate Text

- Keyword Research

- Business Idea Generation

- Business Entrepreneur

- Use ChatGPT on WhatsApp

- Virtual Research Assistant

- Meta-Analysis in Research

- Large Documents

- Hypothesis Development

- Share ChatGPT Responses

- Text Analysis

- Upload PDF on ChatGPT

- Books ChatGPT